LendingTree Spring,

where smart habits

take root

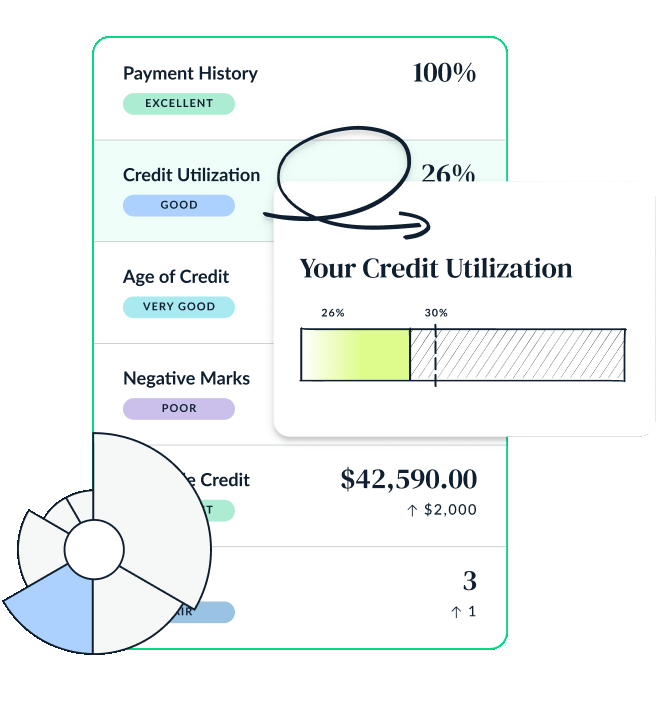

Track your credit score, get personalized recommendations, and unlock a whole new world of financial potential with step-by-step guidance designed uniquely for you. And the best part? It’s 100% free.

Sign Up For FreeWe use encryption to keep your data safe.